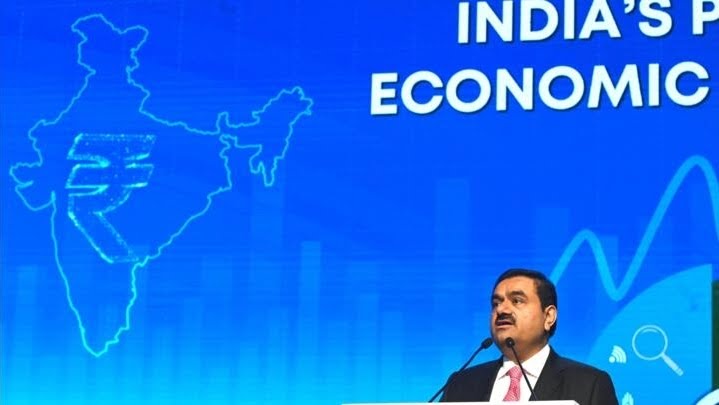

As shares in his company fell once further on Friday, beleaguered Indian tycoon Gautam Adani disputed that Prime Minister Narendra Modi was to blame for his ascension to become Asia’s richest man, a title he lost in a spectacular stock market crash.

Since US short-seller Hindenburg Research, which profits by betting on shares collapsing, produced an explosive report last week, the aggregate market capitalization of his listed units has fallen by more than $120 billion, or over half of the group’s value.

Calling it a “brazen stock manipulation and accounting fraud scheme” and “the largest con in corporate history,” it accused Adani of accounting fraud and artificially inflating its share prices.

Critics assert that Adani’s close friendship with Gujarat-born Modi has given him an advantage in the business world and allowed him to avoid oversight.

Adani said on Friday on India Today television that the accusations were unfounded and that because of their common ancestry, he was a “easy target” for them.

He insisted, “The fact is, my professional success is not because of any specific leader.

His remarks came as shares of his company’s flagship, Adani Enterprises, were repeatedly suspended from trading on the Bombay Stock Exchange. The shares eventually fell by 30% before losses were pared.

When they reached their limits, Adani Power, Adani Green Energy, Adani Total Gas — in which French energy giant TotalEnergies has a 37.4% stake — and Adani Transmission were also suspended.

On Friday, opposition lawmakers once more demanded that the government allow a debate on Adani and the exposure of Indian financial institutions to the company. As a result, Parliament was suspended for a second day in a row.

Adani’s personal wealth has fallen by tens of billions of dollars, knocking him out of the top 20 real-time Forbes rich list, where he previously ranked third.

A 60-year-old school dropout who avoids the spotlight, he has watched his operations grow quickly, with shares of Adani Enterprises rising more than 1,000% in just the last five years.

But late on Wednesday, his principal company called off a $2.5 billion stock sale intended to boost investor confidence, lower debt levels—a long-standing concern—restore trust, and increase shareholder numbers.

The offer only succeeded because of huge institutional buyers, fellow Indian businessmen, and $400 million from IHC of the United Arab Emirates, rather than “mom and dad” retail investors.

According to Bloomberg News, major financial institutions including as Credit Suisse and Citigroup no longer recognise Adani bonds as security for loans to private clients, adding to concerns about the conglomerate’s ability to obtain new capital.

Despite this, bonds made a little gain on Friday when bankers from Goldman Sachs and JPMorgan informed customers that some of Adani’s holdings were still healthy, according to Bloomberg, which cited anonymous sources.

By putting money into the equities through offshore tax havens, Adani allegedly artificially inflated the share prices of its units.

The organization said that it had profited from a “decades-long pattern” of tolerance from the government and that “investors, journalists, citizens, and even politicians have been unwilling to speak out for fear of retaliation.”

In a 413-page response released on Sunday, Adani claimed that it had been the target of a “maliciously mischievous” reputational attack and that Hindenburg’s assertions had been “nothing but a falsehood.”

In response, Hindenburg claimed that Adani had largely ignored the queries posed in its report.

Analysts claim that the unrest has damaged India’s reputation at a time when it is attempting to lure foreign investors away from China.

According to Bloomberg, citing anonymous sources, India’s central bank has requested information from lenders regarding their exposure to the Adani Group, whose interests include ports, telecoms, airports, media, coal, oil, and solar power.

Adani claimed in his interview on Friday that only 32% of the loans his companies had taken out were due to Indian banks, with over half coming from foreign bonds.